Instant Bank Transfers

Instant Bank Transfers (IBT) are a faster way to pay money from your bank account into a finance product. As the name suggests, the payment is received instantly (or almost instantly as we found out) and is then available to the customer to use.

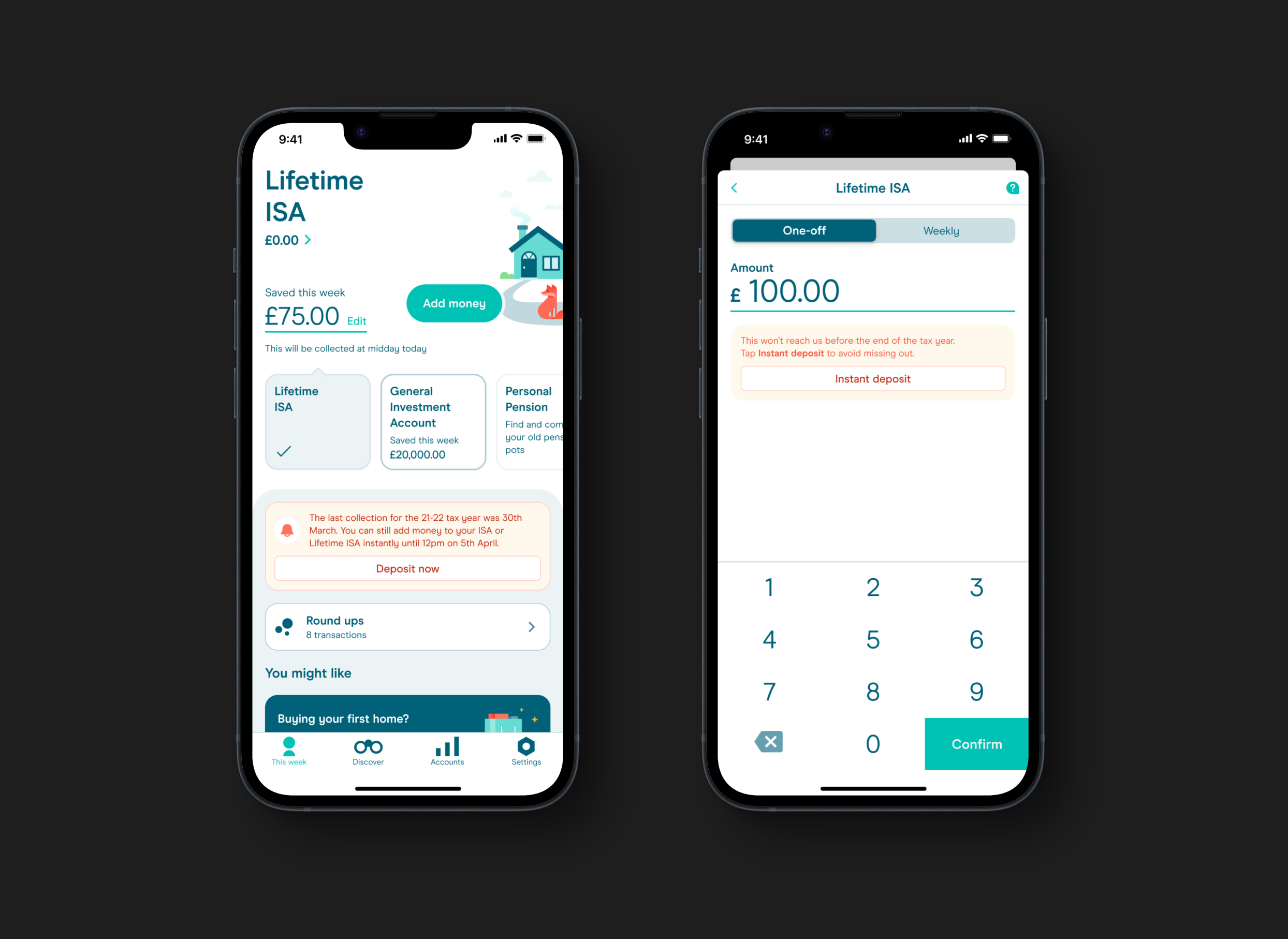

Prior to concepting, designing and delivering Instant Bank Transfers, the only payment mechanism at Moneybox was Direct Debits (DDs). DDs are still available as method for collecting money on a cycle and are collected weekly in order to help customers build wealth over time. IBTs are now available on top of this as a way to provide more variety to customers.

Summary

This was one of the most successful payment-related projects to have been delivered at Moneybox, leading to over 100,000 transactions at launch with the largest single daily amount deposited.

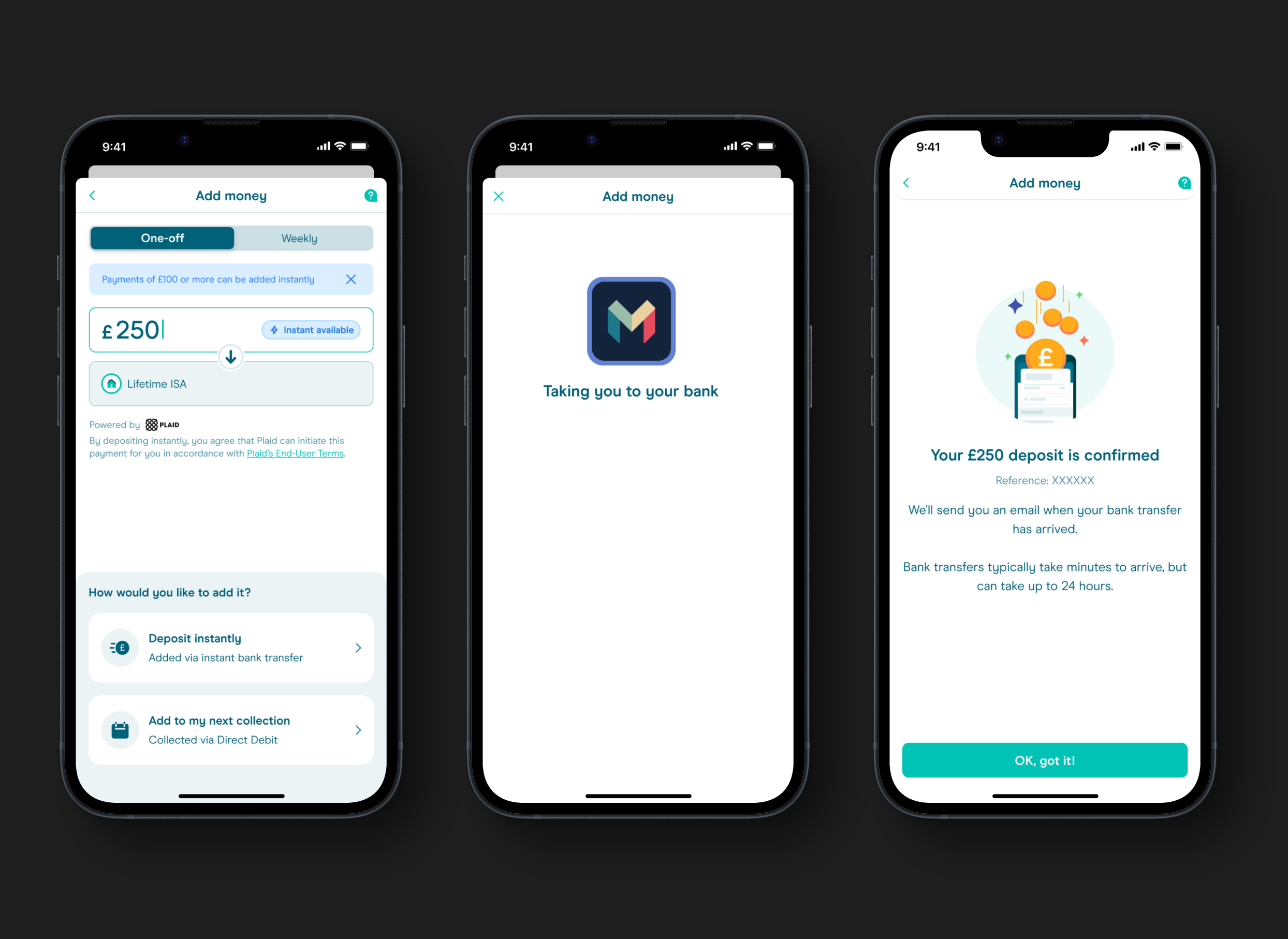

The IBT project work has since spread from Cash LISA to Stocks & Shares LISA, Stocks & Shares ISA and General Investment Account. Our work on allowing customers to IBT straight into their allocation on investment accounts has also improved conversion significantly, leading to an average of 10% uplift across all products.

Customer feedback on these projects has also been off the charts good, with many customers taking to Intercom and social channels to provide feedback.

Our IBT work also led to some opportunities to deliver the most successful tax year end on record for Moneybox. We had a hypothesis that if we enabled IBTs for customers in the 5 day downtime where our collection cycle would miss the end of the tax year, customers would deposit more money and max out their accounts more often. Our hypothesis proved to be true, the work we completed led to over 10 million clicks of the Deposit Now notification card during the week of Tax Year End, and led to 30% more in total savings across around 30,000 different transactions and very much informed our next steps about one-offs.

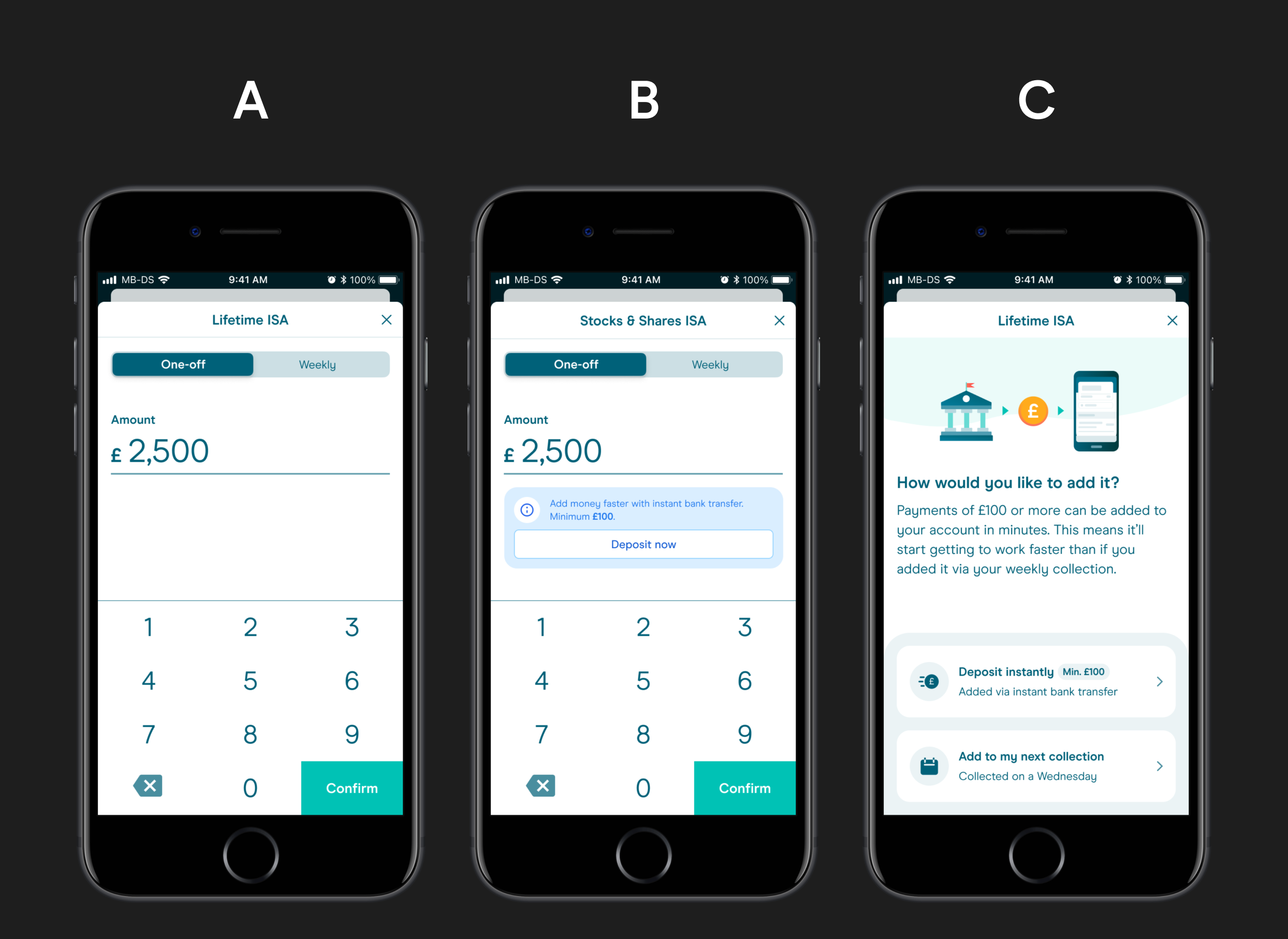

The one-offs payment updates are the best indicator of an optimal full end-to-end process, from early customer research, to understanding the problem deeper via design-led workshops. From testing and iterating a multitude of prototypes at different levels of fidelity with customers both inside and outside of Moneybox, through to testing successful prototypes with real customers via A/B testing with post-launch monitoring.

This allowed us to show that 88% of customers validated our hypothesis that instant payments are preferred—informing our later tests that were built in mid-2022. This one-offs change is the biggest change to payments at Moneybox since we moved away from offering just Round Ups, and sets the tone for the future.

Our final IBT improvements design following the initial A/B test and workshop.